Want the good news?

If you're anything like me, you've discovered how easy it is to use Paypal. Everyone understands it now (after many years of it being around), and people “get” that they can make a payment even if they don't have a Paypal account. So maybe you've set up an e-commerce solution and linked it to Paypal. Maybe you've used it for a small non-profit to accept donations. Maybe you've noticed that a lot of plugins support it – especially those membership ones that you want to use on your member-based, content-protected site. Well, the good news is it's easy and everywhere.

There's bad news coming, right?

In order for Paypal to put money into my account, it also has to have the right to take money out of my account. I get that. You get that. We all get that. But there's some basic logic to the process, right? Take money out when I want to pay for something. Put money in when I am paid for something. It all seems so basic. But from the beginning of Paypal's history, they were dealing with fraud.

So logically, they implemented a feature that lets them put a hold on your funds for a period of time in case there are refund requests. I get that. I don't love it. But I get that. They hold a portion of the funds for 90 days and then it's yours.

But what happens when that portion isn't small? What happens when it impacts your business? You get a little bit screwed. I know, crass language, but hey, it's not a nice feeling.

Wait, does it get worse?

If frozen funds is all that was going on, I'd be unhappy with Paypal, but I wouldn't hate them. But it gets worse – way worse.

This past December, on a family trip to Disneyland of all places, a full week after someone had paid me for services rendered (not the sale of a refundable product), Paypal decided it wanted some of my money.

This was after they'd already put it into my account. So what did they do?

They went into my checking account and grabbed 70% of the funds that had been paid to me. Yes, $700 dollars were yanked out. Without notice or approval. Without complaint from the customer.

Apparently Paypal wanted more funds in their accounts for the holidays.

So I switched to Stripe

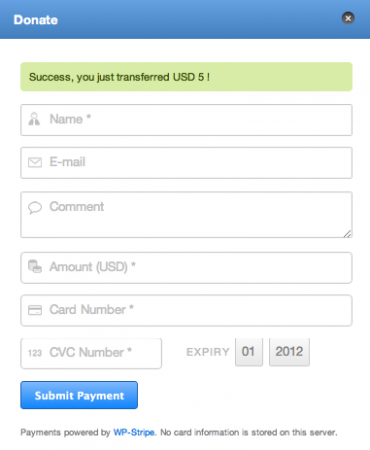

What's Stripe? Well, it's a no-contract payment gateway that lets you collect payments, including recurring payments, and push the money to your own account. It does all this without your needing to store credit card information, which means two things for your sites:

- You have to use SSL on your site to collect the information (which means you need a private IP)

- You don't have to worry about storing credit cards and PCI compliance requirements.

Want to ask more questions? Visit the Stripe site.

Setting up an account is fast and free. And it gets money in your account for 2.9% plus .30 per transaction. That's a great deal!

Stripe works great with WordPress

So I decided it was time to start using Stripe. Switching to Stripe was incredibly easy. There's even a fantastically easy to use plugin, called WP Stripe.

There's an add-on for Gravity Forms, which I think is awesome. But here's the thing, right now it has issues and the programmer has said she fixed it but hasn't released it yet. In fact, she's only shared advanced copies with people who've donated. So for now, I'm waiting to see if she pushes it out.

There's an add-on for Gravity Forms, which I think is awesome. But here's the thing, right now it has issues and the programmer has said she fixed it but hasn't released it yet. In fact, she's only shared advanced copies with people who've donated. So for now, I'm waiting to see if she pushes it out.

But for small organizations and non-profits, WP Stripe works just fine, giving you a simple pop-up that lets someone donate.

So if you're ready to give it a try, or at least see what it looks like, you can visit my donation page. But be warned, your donation has to be at least $.50.